Prepare to conquer the AP Macroeconomics Unit 2 Test with this comprehensive guide! Dive into the fascinating world of macroeconomic concepts, models, and policies, and gain a solid understanding that will empower you on test day and beyond.

In this guide, we’ll explore the intricacies of GDP, inflation, unemployment, fiscal and monetary policies, and more. Get ready to unlock the secrets of economic stabilization, international trade, and global economic issues.

Macroeconomic Concepts and Models

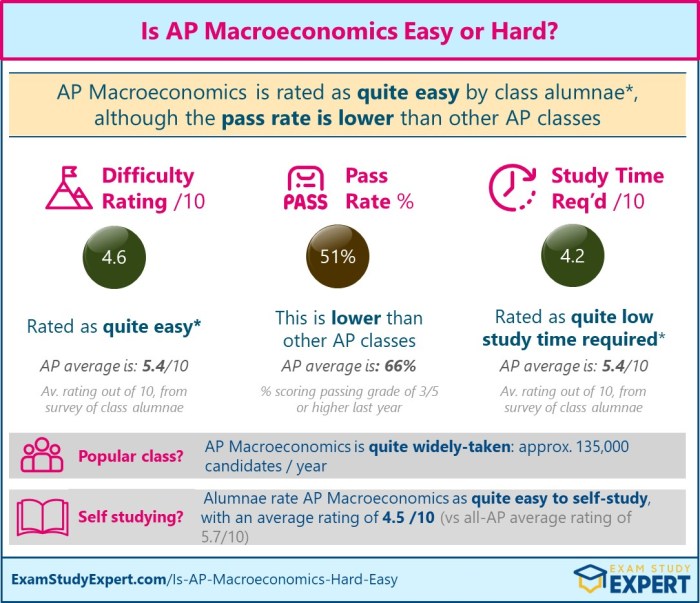

Macroeconomics examines the economy as a whole, focusing on variables like GDP, inflation, and unemployment. It employs various models, such as the Keynesian model, which emphasizes government intervention to stimulate demand, and the classical model, which advocates for limited government intervention and a self-correcting economy.

GDP

Gross Domestic Product (GDP) measures the total value of goods and services produced within a country’s borders over a specific period, typically a quarter or a year. It is a key indicator of economic activity and growth.

Inflation

Inflation refers to the sustained increase in the general price level of goods and services over time. It erodes the purchasing power of money and can have significant economic consequences.

Unemployment

Unemployment measures the percentage of the labor force that is actively seeking work but unable to find it. It can result from various factors, including economic downturns, technological advancements, and changes in consumer demand.

Keynesian Model

The Keynesian model, developed by John Maynard Keynes, argues that aggregate demand, or total spending in an economy, is the primary determinant of economic output. It suggests that government spending can increase aggregate demand and stimulate economic growth during recessions.

Classical Model

The classical model, associated with economists like Adam Smith and David Ricardo, believes that the economy is self-regulating and that government intervention can often hinder economic growth. It emphasizes the importance of free markets and limited government involvement.

Measurement of Economic Activity

Measuring economic activity is crucial for understanding the overall performance and health of an economy. Two widely used methods for measuring economic activity are Gross Domestic Product (GDP) and Consumer Price Index (CPI).

GDP

GDP is the total value of all goods and services produced within a country’s borders during a specific period, typically a quarter or a year. It provides a comprehensive measure of the size and growth of an economy.

- Advantages: Provides a broad measure of economic activity, including production, consumption, and investment.

- Limitations: Does not capture non-market activities (e.g., housework, volunteer work), can be distorted by inflation, and may not reflect changes in quality or technological advancements.

CPI

CPI measures the changes in the prices of a basket of goods and services consumed by households. It is used to track inflation and calculate the purchasing power of money.

- Advantages: Provides a timely measure of inflation, allowing policymakers to adjust monetary and fiscal policies.

- Limitations: Can be affected by changes in consumer preferences and substitution effects, may not fully capture the cost of living, and can be distorted by changes in quality or new product introductions.

Fiscal Policy

Fiscal policy refers to the use of government spending and taxation to influence the economy. It is one of the primary tools used by governments to manage economic growth, inflation, and unemployment.

Tools of Fiscal Policy

The two main tools of fiscal policy are:

- Government spending:The government can increase or decrease its spending on goods and services, which directly affects aggregate demand and economic growth.

- Taxation:The government can change tax rates and tax structures to influence consumer and business behavior. This affects disposable income and investment, thereby impacting economic activity.

Effects of Fiscal Policy

Fiscal policy can have significant effects on the economy:

- Economic growth:Expansionary fiscal policy, involving increased government spending or tax cuts, can stimulate economic growth by boosting aggregate demand.

- Inflation:Excessive government spending can lead to inflation if it outpaces the economy’s productive capacity.

- Unemployment:Fiscal policy can influence unemployment rates by affecting aggregate demand. Expansionary policies can reduce unemployment, while contractionary policies may increase it.

Monetary Policy: Ap Macroeconomics Unit 2 Test

Monetary policy is the set of tools used by a central bank to control the money supply and interest rates in an economy. The primary goal of monetary policy is to promote economic growth and stability by influencing the availability and cost of money.Monetary

policy is implemented through various tools, including:

- Interest rates:The central bank can influence interest rates by setting the target rate for short-term loans between banks. By raising or lowering interest rates, the central bank can make it more or less expensive for businesses and consumers to borrow money.

- Open market operations:The central bank can buy or sell government securities in the open market. When the central bank buys securities, it injects money into the economy. When it sells securities, it withdraws money from the economy.

Monetary policy can have significant effects on economic growth, inflation, and unemployment. By influencing the cost and availability of money, the central bank can stimulate or slow down economic activity. For example, lowering interest rates can make it cheaper for businesses to invest and for consumers to spend, which can boost economic growth.

However, if interest rates are lowered too much, it can lead to inflation, which is a general increase in prices. On the other hand, raising interest rates can help to control inflation but may also slow down economic growth and increase unemployment.

International Trade and Finance

International trade and finance involve the exchange of goods, services, and capital across borders. It plays a crucial role in economic growth, resource allocation, and global interdependence.

The AP Macroeconomics Unit 2 test is just around the corner, and it’s important to be prepared. One way to do that is to check out the ACS Private Pilot Study Guide . This guide covers all the topics that will be on the test, and it’s a great way to brush up on your knowledge.

Plus, it’s written in a clear and concise style, so it’s easy to understand. So if you’re looking for a way to ace your AP Macroeconomics Unit 2 test, be sure to check out the ACS Private Pilot Study Guide.

Comparative Advantage and Free Trade

Comparative advantage refers to the ability of countries to produce specific goods or services at a lower opportunity cost compared to others. Free trade allows countries to specialize in producing goods where they have a comparative advantage and trade with others, leading to increased efficiency and global economic growth.

Effects of International Trade

International trade can have significant effects on economic growth and income distribution:

Economic Growth

Trade expands markets, promotes competition, and encourages innovation, leading to increased production, employment, and economic growth.

Income Distribution

Trade can lead to both gains and losses in income distribution. Industries and workers in export-oriented sectors may benefit, while those in import-competing sectors may face challenges.

Economic Growth and Development

Economic growth and development are crucial for improving living standards and overall well-being. Economic growth refers to the sustained increase in the total value of goods and services produced in an economy over time, typically measured by the gross domestic product (GDP).

Economic development, on the other hand, is a broader concept that encompasses not only economic growth but also improvements in various aspects of society, such as education, healthcare, infrastructure, and income distribution.

Factors Contributing to Economic Growth

Several factors contribute to economic growth, including:

- Technological Progress:Technological advancements drive economic growth by increasing productivity and efficiency. Innovations in machinery, production processes, and communication technologies enhance the ability of economies to produce more goods and services with fewer resources.

- Human Capital:A skilled and educated workforce is essential for economic growth. Human capital refers to the knowledge, skills, and abilities possessed by individuals in an economy. Investments in education and training increase human capital, leading to higher productivity and innovation.

- Capital Formation:Capital formation involves the accumulation of physical capital, such as machinery, equipment, and infrastructure. Adequate capital stock is necessary to support economic growth by increasing production capacity and efficiency.

- Natural Resources:Access to abundant natural resources, such as land, minerals, and energy, can contribute to economic growth. However, the sustainable management of natural resources is crucial to avoid depletion and environmental degradation.

Challenges and Opportunities of Economic Development

Economic development presents both challenges and opportunities for different countries:

- Income Inequality:Rapid economic growth can sometimes lead to income inequality, where a small segment of the population captures a disproportionate share of the benefits. Addressing income inequality is crucial for promoting social cohesion and ensuring that the benefits of economic development are widely shared.

- Environmental Sustainability:Economic growth can put a strain on the environment through increased resource consumption, pollution, and greenhouse gas emissions. Sustainable development practices are necessary to balance economic growth with environmental protection.

- Political Stability:Political stability and good governance are essential for economic development. Stable political environments attract investment, encourage entrepreneurship, and create conditions conducive to long-term growth.

- Global Integration:Globalization and international trade offer opportunities for economic development by expanding markets and accessing new technologies. However, countries need to carefully navigate the challenges of globalization, such as increased competition and potential job losses.

Inflation and Unemployment

Inflation and unemployment are two key macroeconomic variables that have significant implications for economic growth and stability. Understanding the causes and consequences of inflation and unemployment is essential for policymakers and economists.

Inflation is a sustained increase in the general price level of goods and services in an economy over time. It can be caused by various factors, including excess demand, cost-push pressures, and monetary expansion. Inflation can have both positive and negative consequences.

On the one hand, it can stimulate economic growth by encouraging investment and consumption. On the other hand, it can erode the purchasing power of consumers and lead to social unrest.

Unemployment is a situation in which individuals who are actively seeking work are unable to find a job. It can be caused by factors such as technological advancements, structural changes in the economy, and recessions. Unemployment has severe consequences for individuals, families, and the economy as a whole.

It can lead to financial hardship, social isolation, and reduced economic output.

Relationship between Inflation and Unemployment: Phillips Curve

The Phillips curve is an economic model that suggests an inverse relationship between inflation and unemployment. According to the Phillips curve, when inflation is high, unemployment tends to be low, and vice versa. This relationship is based on the idea that when the economy is growing and inflation is rising, businesses tend to hire more workers, reducing unemployment.

Conversely, when the economy is slowing down and inflation is falling, businesses tend to lay off workers, increasing unemployment.

However, the Phillips curve is not always a reliable predictor of the relationship between inflation and unemployment. In some cases, the Phillips curve can shift, making it difficult to predict the impact of inflation on unemployment and vice versa. Factors that can shift the Phillips curve include technological advancements, globalization, and changes in government policies.

Economic Stabilization

Economic stabilization policies aim to minimize fluctuations in economic activity, promoting stable economic growth and price levels. They address economic downturns (recessions) and periods of high inflation.

Fiscal Policy

Fiscal policy uses government spending and taxation to influence economic activity. During a recession, the government may increase spending or reduce taxes to stimulate demand and boost economic growth. Conversely, during periods of high inflation, the government may reduce spending or increase taxes to reduce demand and curb inflation.

Monetary Policy

Monetary policy is implemented by central banks, such as the Federal Reserve in the United States. It involves adjusting interest rates and the money supply to influence economic activity. Lowering interest rates can stimulate economic growth by making borrowing more affordable, while raising interest rates can reduce inflation by discouraging borrowing and spending.

Automatic Stabilizers

Automatic stabilizers are built-in mechanisms that help stabilize the economy without direct government intervention. Examples include progressive income taxes (which take a higher percentage of income during economic booms) and unemployment benefits (which provide support during economic downturns).

Global Economic Issues

Globalization, climate change, and income inequality are significant challenges and opportunities that shape the global economy.

Globalization, Ap macroeconomics unit 2 test

Globalization has interconnected economies worldwide, leading to increased trade and investment. While it offers opportunities for economic growth and development, it also brings challenges such as job displacement, cultural homogenization, and environmental degradation.

Climate Change

Climate change poses significant risks to the global economy. Extreme weather events, rising sea levels, and changing agricultural patterns can disrupt production, infrastructure, and livelihoods. Mitigating and adapting to climate change require significant investments and cooperation among nations.

Income Inequality

Income inequality has become a growing concern globally. The gap between the rich and the poor is widening, leading to social unrest, political instability, and reduced economic mobility. Addressing income inequality requires comprehensive policies that promote inclusive growth and equitable distribution of wealth.

Role of International Organizations

International organizations, such as the International Monetary Fund (IMF) and the World Bank, play a crucial role in addressing global economic issues. They provide financial assistance, technical support, and policy advice to countries facing economic challenges. These organizations also facilitate international cooperation and coordination on economic matters.

Common Queries

What is the significance of GDP in macroeconomics?

GDP (Gross Domestic Product) is a crucial measure of a country’s economic activity. It represents the total value of all goods and services produced within a nation’s borders over a specific period, usually a quarter or a year.

How does inflation impact economic growth?

Inflation, a sustained increase in the general price level, can have complex effects on economic growth. Moderate inflation can sometimes stimulate growth by encouraging investment and spending. However, high or volatile inflation can hinder growth by eroding consumer purchasing power and creating uncertainty for businesses.

What is the role of fiscal policy in managing economic fluctuations?

Fiscal policy involves government spending and taxation. By adjusting these levers, governments can influence economic activity. Expansionary fiscal policy, involving increased spending or tax cuts, aims to boost economic growth during downturns. Conversely, contractionary fiscal policy, with reduced spending or tax increases, seeks to curb inflation or excessive economic growth.